Important Announcement from MCA | 03-May-2021

Announcements By - CA Bhavik | CS Shivani

Announcements By - CA Bhavik | CS Shivani

Due to COVID-19 pandemic, the Ministry of Corporate Affairs has issued the General Circular 06/2021, 07/2021 and 08/2021 on 03.05.2021 allowing stakeholders to file various forms due for filing during 01.04.2021 to 31.05.2021 under the Companies Act, 2013/LLP Act, 2008 by 31.07.2021 without payment of additional fees. The key features of the Circulars are summarised below:

Key Features of the General Circular No. 06/2021 issued by MCA on 03.05.2021

Relaxation on levy of additional fees in filing of certain Forms under Companies Act /LLP Act: MCA has provided relaxation on levy of additional fees on filing all forms except Form CHG-1, Form CHG-4 and CHG-9 which are due for filing during 01.04.2021 to 31.05.2021 provided the said forms are filed by 31.07.2021.

Key Features of the General Circular No. 08/2021 issued by MCA on 03.05.2021

Relaxation on Gap between two Board Meetings under section 173 of the Companies Act, 2013: As per Section 173 of the Companies Act 2013, the gap between two consecutive board meetings should not exceed 120 days, but due to the difficulties arising due to resurgence of COVID-19, MCA extended the same by 60 days for first two quarters of financial year 2021-22. According to this, the gap between two consecutive Board Meetings may extend to 180 days during the quarters, April to June and July to September.

Key Features of the General Circular No. 07/2021 issued by MCA on 03.05.2021

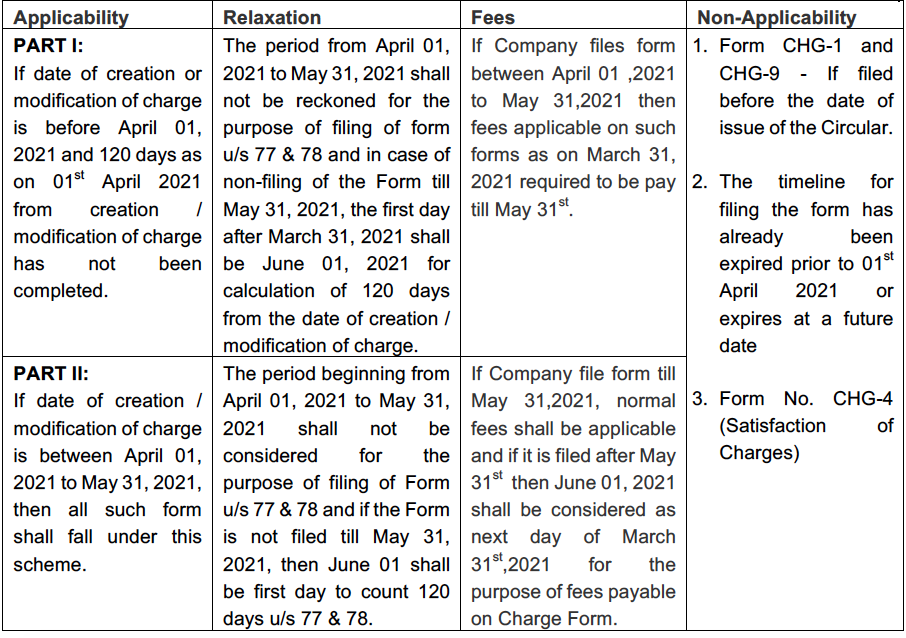

Relaxation of time for filing forms related to creation or modification of charges under the Companies Act 2013: As per 77 of the Act, Form CHG-1 and CHG-9 relating to Creation and Modification of Charge need to be file in maximum 120 days from date of creation or modification subject to payment of fees / additional fees. There is a relaxation given in calculation of the period of 120 days. The details as under:

CA Bhavik | CS Shivani

Blog Disclaimer: “All information contained herewith is provided for reference purpose only. Sharma & Pagaria, Chartered Accountants (S&P CA) ensures accuracy and reliability of the information to the best of its endeavours. While the information contained within this Blog is updated, no guarantee is given that the information provided in this Blog is correct, complete, and up to date. S&P CA makes no warranty or representation as to the accuracy, completeness, or reliability of any of the information contained herein and disclaim any and all liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this Blog is not intended to provide any professional advice.